By Ofuns Okwechime

Introduction

Ever wish and wonder when you will have enough funds to meet your needs? Enough for a deposit for your first place, cover all your bills at the end of the month and have some left over for emergencies? Read on.

It is possible to achieve all this and more through budgeting effectively. Budgeting is an essential life skill that can make a significant difference in your financial well-being. As a young adult just starting to earn money, learning about managing finances is a fundamental concept you should understand.

In this beginner-friendly guide, we will explore how to budget money for young adults. At the end of this guide, you will be able to identify your current relationship with money, understand where you are in that relationship and know what possible steps to take to make your money work better for you in achieving your financial goals.

What Is a Budget?

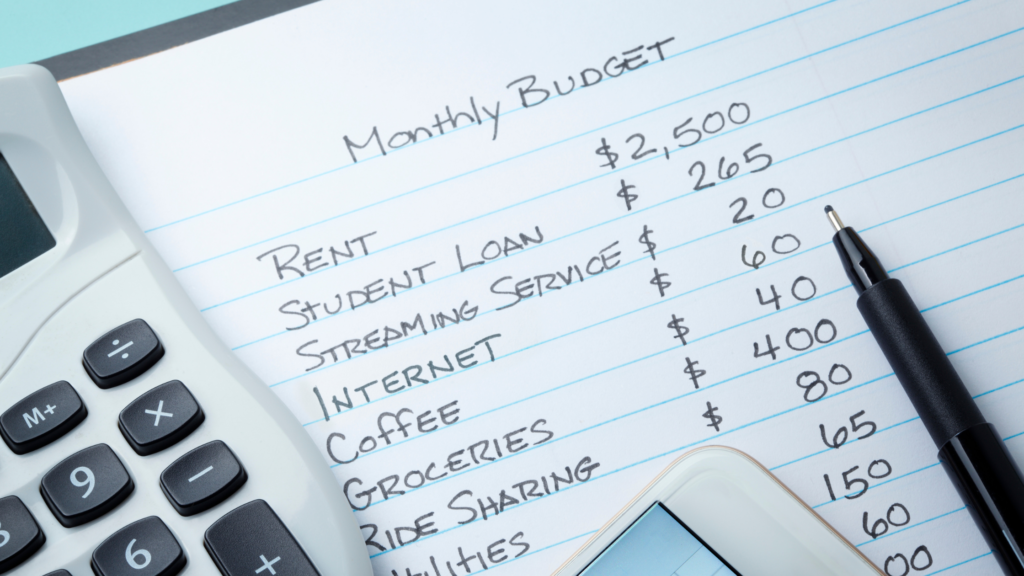

To start our budgeting journey, let’s break down the term “budget”. Think of a budget as a plan for your money. It’s like making a list of how much money you have from all your sources of income, a list of all your expenses or outgoings, and knowing how much you have to allocate to each item on your list, which shows how much you have left.

Why Budgeting Is Important

If you don’t budget, you might run out of money before paying your rent, bills, and groceries. Budgeting helps ensure you always have enough for the important and have some for fun.

Setting Financial Goals

Let’s talk about goals! In the world of budgeting, goals are like dreams.

As a young adult, your goals might be to save up for a new phone, a trip, or even your own place. Setting clear goals helps you know how much money to save each month. You can make a financial plan by completing a budget sheet known as a financial statement, and use the outcome to set goals in your financial plan.

Tracking Your Income

Now, let’s learn about “income.” Income refers to how much money you have coming in regularly. You need to keep track of how much this is. You may also have money from other sources like a side hustle or any investments that may have been made for you. Check your bank statements and payslips to see how much money they have coming in. Then, list the frequency weekly or monthly.

Listing Your Expenses

List your expenses. Expenses otherwise money to be spent are broken down into essential and non-essential expenses. Essential expenses are expenses that we cannot do without. They are usually recurrent like your rent, utilities (water, electricity, gas, sewerage), groceries, and transportation. These are termed essential because they are vital to your well-being.

Non-essential expenses relate to expenses for those items that we need but can limit how much we allocate to them. This could include your phone, clothing and recreation expenses.

Making a list of your expenses helps determine where your money is going.

Creating Your Budget

In creating your budget, you allocate an amount to each item on your budget sheet. Start with your income, then your expenditure. Once done, subtract your expenses from your income, and this should reveal one of three possible outcomes or categories below.

- You have money left over

- You have just enough to cover your expenses

- You have less than you need for your expenses

If you fall into category 1 above, well done. Keep it that way and continue to grow your income. If you are in Category 2, while you have enough to cover your monthly expenses, you may want to explore ways to budget to bring you up to Category 1 and eventually increase your income. However, if you are in Category 3, you have what is referred to as a deficit budget.

- Don’t panic. There are several ways to move up to Category 1 and above.

- The first thing is to address whether you are behind with any bills. If you are behind on any essential expenses, seek help. Several free organisations can advise you on the best options for your current circumstances.

- Check your budget. There may be some items you can adjust in your non-essential expenses. By adopting the spend less than you earn approach, which could be making alternative choices regarding meal planning, the cost of clothing or other items you regularly purchase, your budget could be reduced considerably.

- Is there a way to increase your income in the short or long term?

Saving Money

Saving is like keeping some of your pocket money away for later. It’s essential to learn to save for what you need. Savings help achieve your goals, like a deposit for purchasing your first home, buying a car or going on a holiday.

In your budget, make sure to set aside some money for saving. This way, you can reach your goals without worrying about running out of money.

Emergency fund

As we all know, life happens and we have to be prepared when it does. Before you start saving as a young adult, you should begin to put some funds away for any future emergency. The question is how much is enough for an emergency fund? As a young adult beginning on their budgeting journey, this depends on how much you have to start with.

Once you have created your budget, your long-term goal should be to have enough to sustain you for at least 3-6 months in case there is a sudden change in your circumstances. For example, the loss of a job. These funds act as a buffer until you can secure another job.

Giving

Allocate a portion of your income to giving. At least ten per cent (10%) of your income. This is essential for your well-being and an excellent way to give back from what you have received.

Investing

As a young adult, decide to begin investing because you have the advantage of time. You could use the principles of compound interest to yield a lot for you in the future.

Sticking to Your Budget

Self-control when budgeting as a young adult, it’s hard not to spend all your money on what you want instead of what you need. Sticking to your budget helps you reach your goals and avoid money problems. Using methods of convenience like direct debits or standing orders can help to achieve this.

Adjusting Your Budget

Sometimes, things change. You will need to adjust their budget when things change. Maybe they get a raise at work, or prices go up. It’s essential to review and update your budget when needed. This stresses the need to always be in Category 1 above. Have the mindset that an increase in your income equates to an opportunity to increase your savings and investments.

Budgeting Tools for Young Adults

Now, let’s talk about some tools that can help you budget.

For young adults, some apps and websites can help you track your income and expenses. These tools make budgeting straightforward and accurate.

Tips for Successful Budgeting

We’re almost done! Here are some tips for successful budgeting:

- Be patient and save for the things you want.

- Don’t spend all your money at once; save and invest some for the future.

- Stick to your budget and avoid impulse purchases. Stop! Consider if it is in your budget, and if so, do you need it?

- Review your budget regularly and make changes when needed.

- Seek help or advice from grown-ups or free certified organisations that assist young adults.

Conclusion

Remember, setting goals through a financial plan, tracking your income and expenses, and creating a budget with a budget sheet are the keys to managing your money. With patience and practice, you can become a pro at budgeting and make your financial dreams a reality.

You can take charge of your finances and start budgeting. You’ve got this!